The Main Principles Of Find the Spot Price of Gold Today & Historical

See This Report about 9 Best Gold ETFs to Hedge Volatility in 2021 - Funds - US News

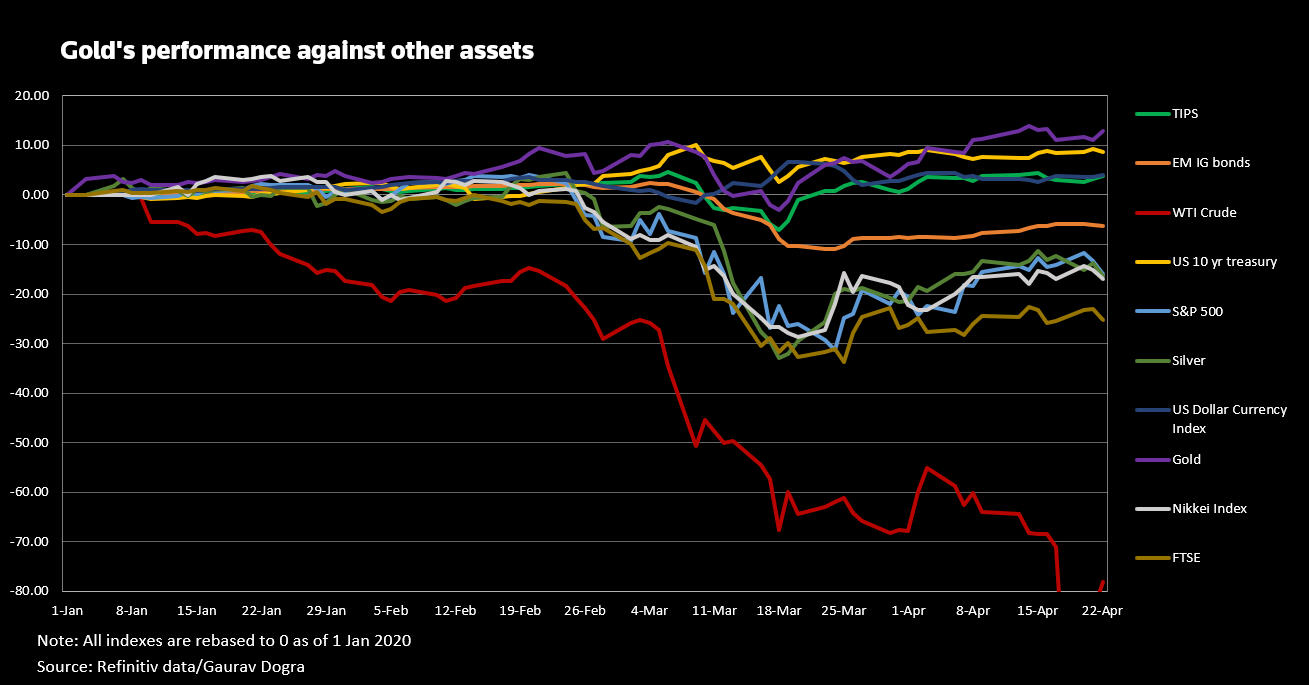

Gold is a popular possession among financiers wanting to hedge versus dangers such as inflation, market turbulence, and political unrest. Aside from buying gold bullion directly, another way to gain direct exposure to gold is by investing in exchange-traded funds (ETFs) that hold gold as their hidden possession or buy gold futures contracts.

Still, the rate of gold can see big swings, indicating ETFs that track it can likewise be unpredictable. Also Found Here of gold significantly underperformed the wider market over the previous year. The ETFs with the finest 1 year tracking overall return are BAR, AAAU, and SGOL. The sole holding of each of these ETFs is gold bullion.

Facts About GLD SPDR Gold Shares Stock Quote - FINVIZ.com Uncovered

These funds either invest straight in gold bullion or in gold futures agreements, rather than business that mine for the metal. The rate of gold futures reduced by 9. 1% over the previous 12 months, vastly underperforming the S&P 500's 1 year overall return of 34. 9%, since Aug.

The best-performing gold ETF, based on efficiency over the previous year, is the Granite, Shares Gold Trust (BAR). We examine the 3 best gold ETFs listed below. All numbers listed below are as of Aug. 16, 2021. Performance Over One-Year: -8. 0% Expense Ratio: 0. 17% Yearly Dividend Yield: N/A 3-Month Typical Daily Volume: 329,652 Assets Under Management: $1.

The Best Strategy To Use For BullionVault's Gold Price Chart

31, 2017 Provider: Granite, Shares BAR seeks to track the performance of the rate of gold bullion, less fund expenses. The ETF is structured as a grantor trust, which might provide a certain degree of tax defense to financiers. It provides both a cost-effective and hassle-free way for investors to buy gold.

Like SGOL, BAR has a lower expenditure ratio than that of numerous alternative gold commodity ETFs. The sole holding of the fund is gold bullion, which is kept in vaults in London. Performance Over One-Year: -8. 1% Cost Ratio: 0. 18% Yearly Dividend Yield: N/A 3-Month Typical Daily Volume: 347,692 Assets Under Management: $370.

Some Of XGD.AX - ASX All Ordinaries Gold Index Stock Price - Barchart

Like BAR above, AAAU is also structured as a grantor trust. The sole holding of the fund is gold bullion, which is saved in vaults in London. On Dec. 4, 2020, Goldman Sachs Asset Management, L.P. ended up being the sponsor of the trust, and the name of the trust was altered from Perth Mint Physical Gold ETF to Goldman Sachs Physical Gold ETF.

UNDER MAINTENANCE